About Tax Sentral

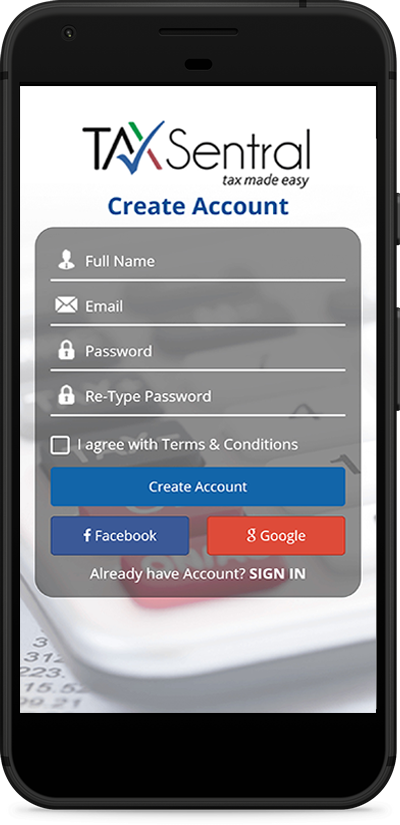

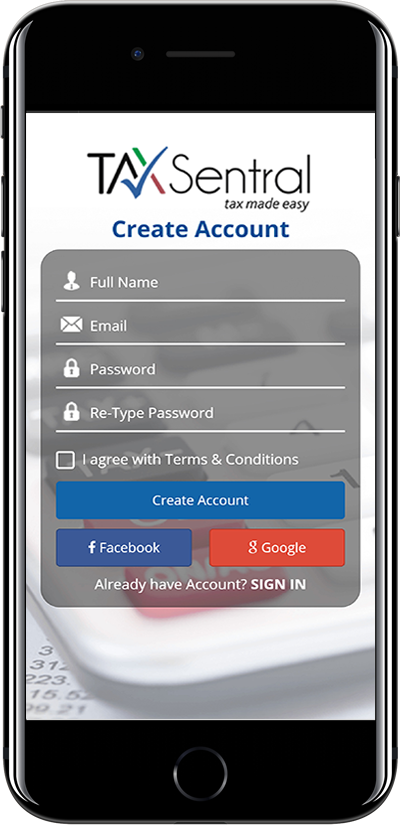

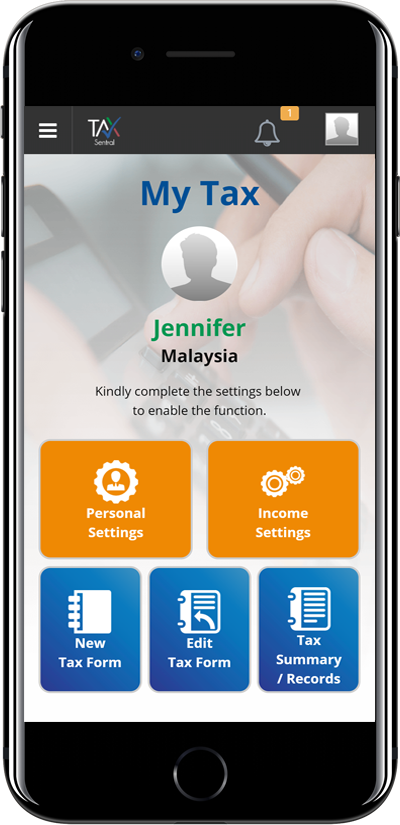

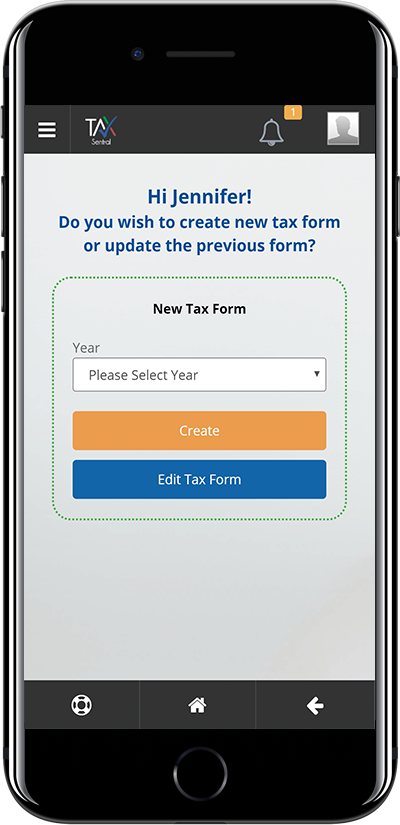

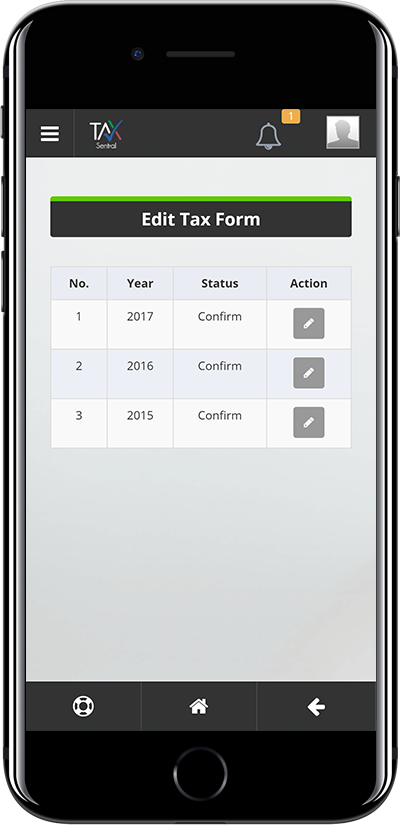

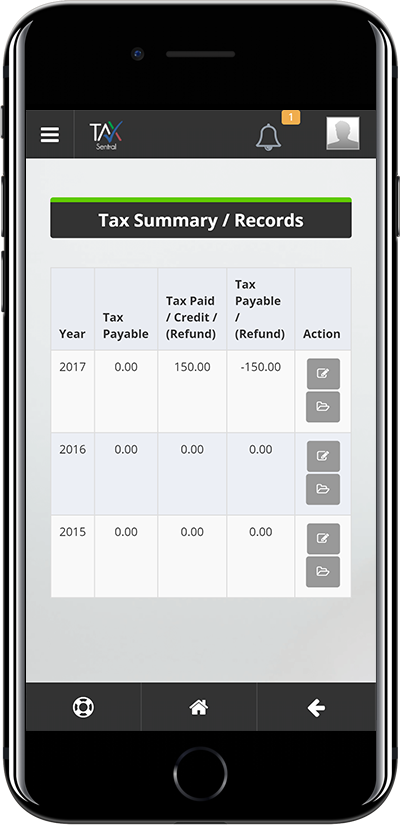

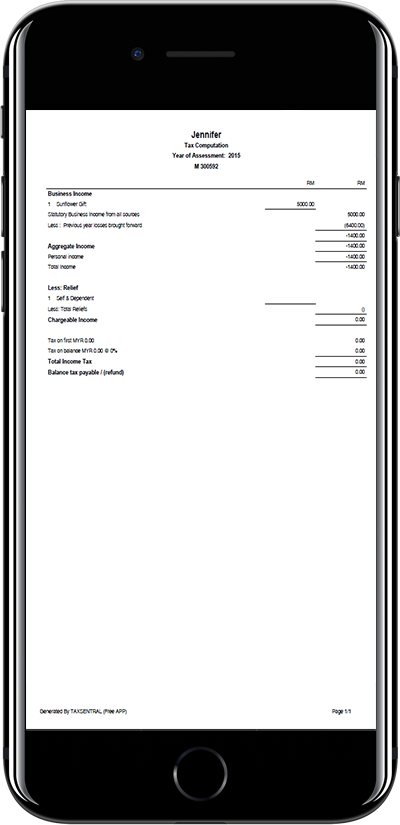

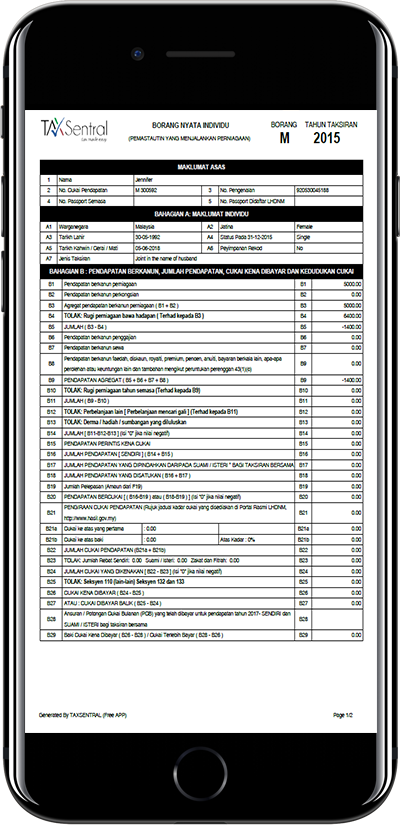

It is a platform to manage personal, micro and small businesses tax affairs and record keeping. Through our Tax Sentral mobile application, you can manage your personal tax hassle free with no cost. Able to upload documents, calculate & save tax information, send and share with ease.

Tax Sentral also provide professional services on various tax compliance requirements and record keeping to individual, small & micro enterprises (SME's), through our support centers in order to manage their tax affairs efficiently and effectively.

Tax calculation and record keeping made easy

Simplified & user friendly tax calculation interface

Personalised according to taxpayer country settings

Get It Now

Download TaxSentral App Now !

FAQs

We at Tax Sentral are dedicated to clear your minds of tax fundamentals and rules.

-

Form BE for having Employment & other sources of income.

Form B for having Business & other sources of income.

Form M for Non Resident Tax payer.

-

Form BE by 30th April.

Form B by 30th June.

Form M by 30th April.

-

Personal & family detail documents.

Copy of the tax return form & acknowledgment of submission.

Tax payment receipts.

Relief claim documents.

Zakat & fitrah payment receipts.

-

Need to keep it for 7 years from the date of submission.

-

Rebate is deduction given from tax charge. RM400 if the chargeable income is RM35,000 or less.

-

Zakat & fitrah deductions are allowed from tax charge for payments made during the basis year.

-

Tax audit is inspection by IRB if income reported & claims made are correct according to tax rule applicable to that year.

-

You are able to enjoy the progressive tax rates, reliefs and rebate.

Treaty protection is also only available to tax residents.